UK-based financial services provider Barclays has launched two new features within its mobile app, Barclays Pingit. ‘Mobile Checkout’ is a payment feature for quick and easy purchases from a mobile web or app checkout page, and ‘Buy It’ bridges the gap between advertising and sales by enabling consumers to purchase advertised goods and services immediately.

The new mobile payment features have been included to enable retailers to offer their customers a fast, easy and secure way to pay for goods and services.

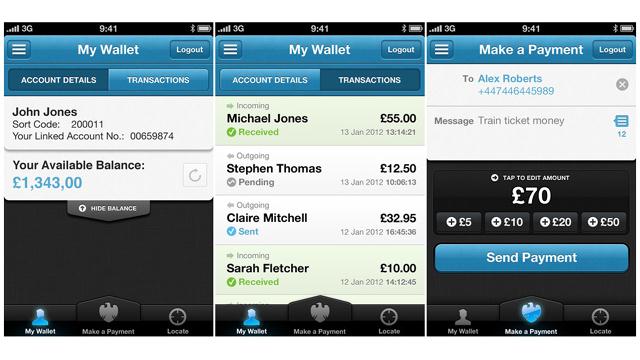

The ‘mobile checkout’ feature is optimised for a mobile experience, with a few clicks required to make an instant settlement via a ‘Pay with Barclays Pingit’ button, instead of the need for the entry of long or large amounts of personal details.

The ‘buy it’ feature enables instant purchases from traditional advertising collateral. By logging onto Barclays Pingit, consumers can buy products direct from an advert and other marketing collateral by scanning a Quick Response (QR) code. Barclays Pingit displays the product information – price, merchant information, delivery information and stock levels. Confirming these details enables a Barclays Pingit user to initiate an instant purchase, which can be delivered to a chosen address. Once confirmed, the customer receives a confirmatory SMS and email.

According to Barclays, this process can transform adverts into a highly accessible and convenient sales channel. Additionally, it increases the value of the existing assets of businesses, for example, by enabling people to buy from window displays, or from unmanned display stands, 24×7. Businesses can also encourage immediate sale of items with marketing incentives such as limited time offers, offers on new products and limited stock offers. The feature can also help businesses evaluate the effectiveness of an advertising campaign by tracking adverts that are driving sales.

“For mobile enabled businesses, this is a great way to increase sales conversion by reducing payment input errors and increased consumer assurance at checkout. For new players to the market, it is an easy, low risk way to enter into mobile commerce,” says Mike Walters, head of UK corporate payments at Barclays.

“Mobile commerce has grown more than 250% over the last two years and it is important that businesses provide consumers with a convenient and easy payment method through this channel. ‘Mobile checkout’ and ‘buy it’, can also play a significant role in increasing sales by improving the mobile customer experience, encouraging customers to complete their sale transaction,” adds Walters.

Notifications