Choithrams store external

UAE-based supermarket chain Choithrams’ multichannel strategy – supported by a strong brick-and-mortar network, e-commerce site and digital platforms – has helped the grocery retailer to efficiently serve customers, even during the lockdown.

Over the past couple of months, amidst the COVID-19 pandemic, UAE-based supermarket chain Choithrams has seen a decline in the frequency of shopping at its brick-and-mortar stores, but a significant increase in basket size, much higher compared to decline in frequency. This change has been driven by more people shopping for groceries online.

“Typically, in a brick-and-mortar environment, impulse shopping happens, but we have seen this happening digitally, which has contributed to the increase in basket size,” explains Ashutosh Chakradeo, head of retail for Choithrams.

The trend points towards the crucial importance of amplifying digital transformation initiatives for traditional retailers to develop a sophisticated digital presence.

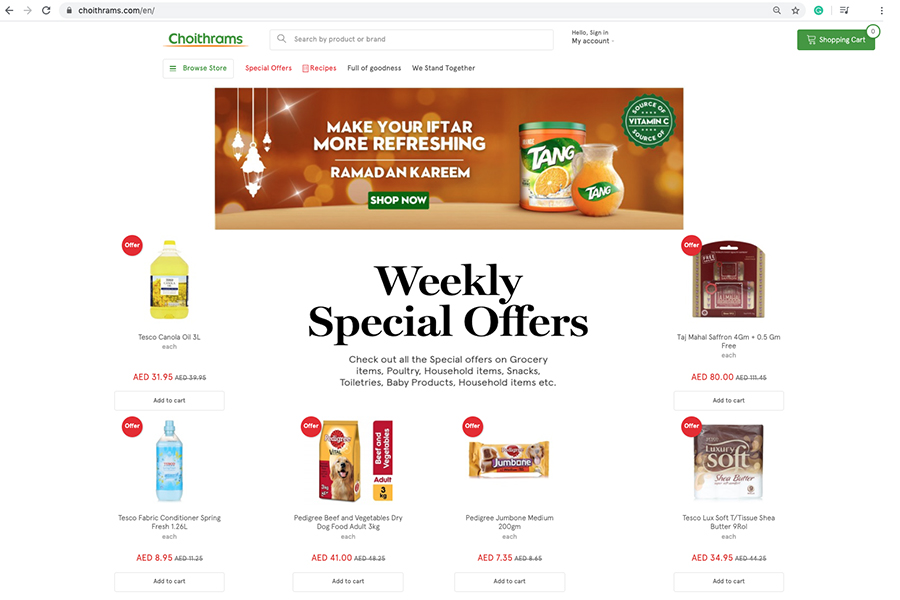

Choithrams’ e-commerce site

Offline supports online

Operating in the UAE for 75 years, Choithrams has built a robust brick-and-mortar infrastructure that has proved crucial in its digital transformation journey, which began around five years ago. “Back then, not many grocery retailers had embarked on an online journey, which gave us the first-mover advantage. Besides, our wide store network, 44 currently, across the UAE supported our online operations, as we can do doorstep delivery within a couple of hours across the emirates,” says Chakradeo.

Choithrams’ online channel has grown quite well over the years, supported by the offline network. “If you are keen to purchase a mobile phone, you can wait. But if you want to buy milk and bread, it must be delivered within a couple of hours on the same day. Therein lies our advantage; we can do doorstep delivery for orders placed across channels – be that online, through WhatsApp, phone or even till the car for a customer shopping at our stores,” stresses Chakradeo.

Especially during the COVID-19 pandemic, grocery retailers with a robust brick-and-mortar presence have been able to handle demand in a much better manner. A great example is Walmart in the US. On the other hand, pure players have somewhat struggled. Think about Ocado in the UK.

Making deliveries efficient

Since Choithrams also accepts orders via WhatsApp, it supported the communities significantly in which the retailer operates, especially during the lockdown. As such, several grocery retailers have struggled to meet delivery timelines for orders placed online. “We too faced some delays on orders placed through our e-commerce site,” admits Chakradeo. “But we were able to do timelier doorstep delivery on orders placed via WhatsApp and telephone. That’s the advantage of operating across multiple channels.”

“But bear in mind, the spurt in demand, especially online, happened suddenly without warning. Our online transactions went up three-four-fold during the past few months since the COVID-19 outbreak in the UAE. So, despite our own last-mile service, collaboration with partners like InstaShop and El Grocer we still faced some delays in deliveries,” he adds.

Tech-enabled demand forecasting

A crucial area of focus for any retailer is a clear line of sight into inventory. Especially during a pandemic like COVID-19, product availability becomes more pivotal. “Irrespective of the current crisis, inventory management is a key focus area for any retailer,” opines Chakradeo. “From an online perspective, product availability is even more crucial compared to a physical store, where the consumer can check other available options more readily. During the initial days of the COVID-19 crisis – around February 2020 – we fast-tracked our import orders to ensure product availability. We also flew in critical product lines by air. Our local suppliers also supported us significantly. We increased our inventory level by 40-50% across most product categories. Moreover, we used technology and data to do demand forecasting. As soon as demand went up, we increased our forecast for the next six months to prevent supply disruption.”

Choithrams is continuously evaluating the use of technology across its operations – right from forecasting demand, ordering to stocking the shelves and selling online. “We use a handheld device while picking products for online orders as well as track the exact location within the store if a customer needs assistance. From route planning to shipping, every aspect is technology-driven. For example, in the past few months, as our order volume increased, we could not ramp up our delivery fleet overnight. Our technology-enabled route planning helped in optimising daily deliveries,” Chakradeo cites.

Delving deeper, he continues, “During the initial days, our data indicated that consumers are focusing on essential categories such as rice, oil, flour, pasta, frozen and cleaning products. Who would have imagined a 10,000% increase in the sale of sanitisers? So, we had to quickly increase forecast for existing products, while also bringing in high-quality alternatives to meet customer demand. For example, if Barilla or Tesco pasta went out of stock, we relied on locally available brands to avoid short-term stockout.”

As the grocery shopping patterns changed drastically, Choithrams relied on data to make quick adjustments. Usually, customers buy products from supermarkets regularly for daily use. But owing to COVID-19, they started stocking up and buying monthly requirements.

“We had to increase the stock levels of bigger bags of, let us say rice and flour. We had to ramp up the manufacturing of certain products under our private label ‘Goodness Foods’. We had to quickly consider such changes in our forecasting tool, facilitated by data on consumer purchase behaviour. We have a demand and replenishment planner that our suppliers refer to across channels – both for stores and online. They also refer to the sales data on a daily and weekly basis to ensure product availability,” Chakradeo elaborates.

“To a customer, every Choithrams store may seem similar, but each outlet is planned differently based on the customer profile of the catchment areas and their shopping patterns. Therein, we use a lot of technology pieces to plan accurately,” he adds. “That is why, despite a 3-4X increase in demand over the past two-three months, we were able to ensure customer service without interruption.”

Digital transformation priorities

When asked about Choithrams’ digital transformation priorities over the next one year, Chakradeo says, “For digital transformation initiatives, we do not look beyond a quarter. It is a highly dynamic space. Within the next six months, we are planning to launch our hyper-local model, which will enable us to ensure doorstep delivery within 30-60 minutes, among other initiatives.”

“There will be a change in the way consumers shop. In that sense, digital transformation plans, which would otherwise take five years, will now get accelerated. We expect our share of digital within sales to increase – almost double – quicker than expected, as consumers who have adopted online grocery shopping will continue even after the crisis, owing to the convenience. Consumers will visit the stores but might reduce the frequency. Overall, they will continue using multiple channels to shop,” he concludes.

For all the latest retail news from the Middle East, follow us on Twitter and LinkedIn, like us on Facebook and subscribe to our YouTube page.

Notifications

You must be logged in to post a comment.