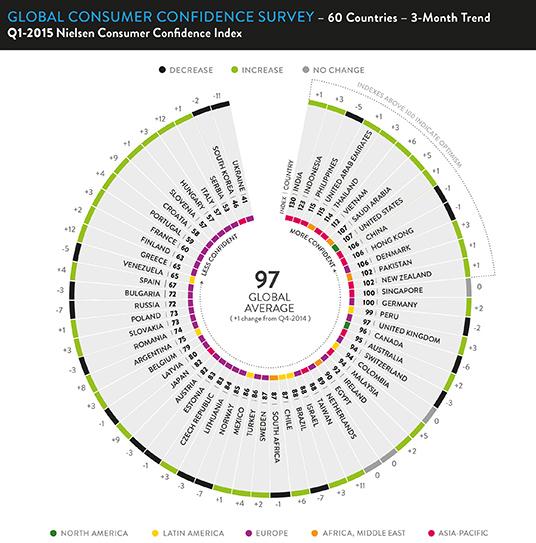

UAE and Saudi Arabia consumer confidence started 2015 with an index score of 115 and 107, respectively, representing an increase of one point and five points, respectively, from the fourth quarter of 2014 and from a year-ago, indicates Nielsen Global Survey of Consumer Confidence and Spending Intentions.

“Consumer confidence increased in three of five countries measured in the Middle East/Africa region in the first quarter. At 115, the UAE had the highest index in the region, while confidence also increased five points in Saudi Arabia to 107. Conversely, confidence decreased one point in South Africa to 87 and remained steady in Egypt at 90,” shares Arslan Ashraf, managing director, Nielsen Arabian Peninsula.

“The government’s ability to continue with its development agenda, despite falling oil prices, has given a boost to consumer morale in the UAE. On the other hand, King Salman’s accession to the throne earlier this year and his resoluteness towards domestic as well as international issues has increased consumer optimism in KSA,” Ashraf explains.

In the UAE, sentiment about job prospects and immediate spending intentions declined five percentage points to 66% and one percentage point to 50%, respectively, while personal finances sentiment increased three percentage points to 67% from the fourth quarter of 2014. The number of UAE consumers who believed they were in recession increased to 39% from 36% the previous quarter and from 33% from a year ago.

In Saudi Arabia, sentiment about job prospects declined two percentage points to 52%, while personal finances sentiment and immediate spending intentions increased four percentage points to 64% and seven percentage points to 48%, respectively, from the fourth quarter of 2014. Recessionary sentiment reached a low of 43%, down from 44% the previous quarter.

UAE discretionary spending intentions increased in the first quarter but not across all lifestyle categories measured. Almost three-in-10 UAE respondents (28%) planned to spend on holidays/vacations and a quarter planned to spend on new clothes (25%) and for paying credit cards and debts (24%), representing quarterly increases of four, two and three percentage points, respectively. Spending intentions for out of home entertainment (16%) and home improvements/decorations (14%) declined five and four percentage points, respectively, from the previous quarter.

Similarly KSA discretionary spending intentions also increased in the first quarter but not across all lifestyle categories measured. About two-in-10 KSA respondents (23%) planned to spend on out of home entertainment and new clothes (18%) and 15% for new technology products, representing quarterly increases of one, one and two percentage points, respectively. Spending intentions for paying credit cards and debts (21%) declined two percentage points from the previous quarter.

Saving intentions in the UAE, on the other hand, showed a slight increase of one percentage point each for investing in stocks and mutual funds (13%) and one percentage point for retirement savings (12%) from the fourth quarter of 2014. More than half of UAE respondents planned to bank their spare cash (53%), an increase of 3 percentage points from the previous quarter, while 11% said they had no spare cash, down from 14% the previous quarter.

KSA saving intentions, on the other hand, showed a slight increase of three percentage points each for investing in stocks and mutual funds (11%) and remained stable for retirement savings (4%) from the fourth quarter of 2014. More than four-in-10 KSA respondents planned to bank their spare cash (41%), an increase of 6 percentage points from the previous quarter, while 21% said they had no spare cash, down from 25% the previous quarter.

The Nielsen consumer confidence index measures perceptions of local job prospects, personal finances and immediate spending intentions, among more than 30,000 respondents with internet access in 60 countries.