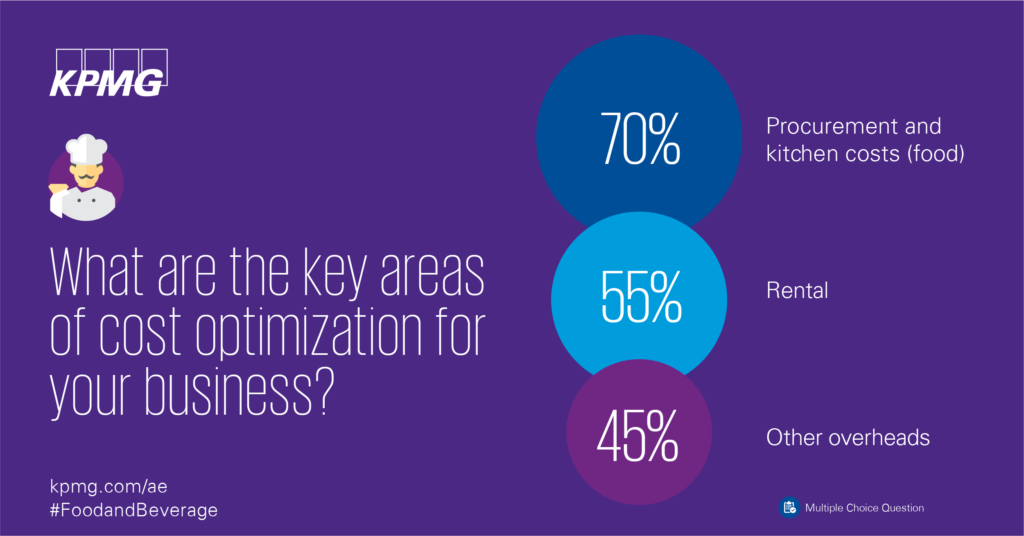

According to KPMG’s 2018 F&B Report, food and beverage (F&B) operators in the UAE are looking to enhance operations and rationalise costs to maintain margins, as response to headwinds facing the industry. The F&B operators seek to closely review and adjust portfolios, while opting to exit loss-making outlets and struggling brands.

The UAE, however, continues to lead the F&B market in the Middle East region, stimulated by a growing number of tourists. The sector’s growth is further supported by the entry of new international and regional brands. The restaurant footprint, number of restaurants per million residents in Dubai remains high, second only to Paris.

“Last year was a challenging one for the F&B industry, in the face of increased competition, higher operating costs and comparatively tepid consumer sentiment,” observes Anurag Bajpai, partner and head of retail for KPMG Lower Gulf. “Despite this, the sector has demonstrated resilience as owners and operators have responded with measures to drive operational efficiencies, and take difficult but essential decisions. We step into 2019 with a cautiously optimistic medium-term outlook for the sector, bolstered by trends such as delivery-led revolution and expectations around Expo 2020 – over 4 out of 5 operators we surveyed expect growth in the medium-term.”

According to the report, among all formats in the UAE, quick-service restaurants (QSRs) were more popular in 2018 due to value-seeking customers. For premium dining outlets, relatively steady patronage for certain popular brands and concepts continued, with hotel-based premium licensed offerings facing increased competition from licensed non-hotel outlets.

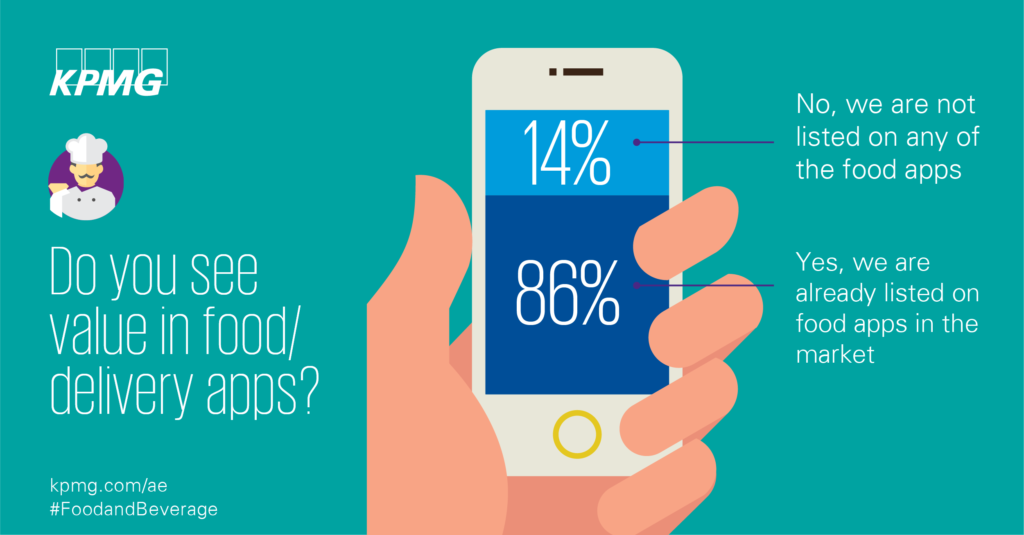

The report also found that the delivery segment witnessed year-on-year growth and use of rental kitchens is picking up in the UAE. As many as 32% of operators (versus 21% last year) attribute more than a quarter of their revenue to the delivery channel.

As opposed to 2017, when operators’ attention was focused on expansion into new markets and geographies, the broader theme for 2018 was to put the house in order. Many investments were aimed at operational improvements and local expansion of the winners in their existing portfolios.

At the same time, with the introduction of value added tax (VAT) in the UAE, most F&B operators, like other retail businesses, continued to focus their attention on pricing strategy. Within the F&B industry, changes were primarily addressed through repricing and other strategies, such as combo offers and menu refreshes.

“Looking ahead, operators are optimistic about the impact Expo 2020 Dubai will have on the industry. More than half of operators believe Expo 2020 will have a favourable impact and the event has the potential to provide a much-needed fillip to the industry,” adds Vikrant Rohatgi, director in the advisory practice for KPMG Lower Gulf. “Further, more than one-third of operators currently plan to directly participate by establishing a presence at the site.”

Notifications

You must be logged in to post a comment.