Middle East’s vegan revolution

Today’s on-demand streaming services are ripe with docu-series and explainer videos on the vegan revolution that is happening globally. When Kip Andersen’s Cowspiracy came out in 2014, it did not just shock the world of the environmental impact of animal agriculture, but it created various mainstream conversations around livestock rearing.. With more of these dialogues taking place in the media in the last decade, more people are adopting the vegan and plant-based lifestyle. According tocalculations, as of September 2020, there are approximately 78 million vegans in the world. As a result, there has been a progressive spike in the demand of vegan products – from food items, to cosmetics, and even clothing labels.

Vegan products are fast filling up and flying off the shelves of major department stores. For example, WaitroseUK reported vegan and veggie barbecue food sales soared by 80% this year. Back in 2018,they had launched vegan sections in more than 130 stores after increasing its vegan and vegetarian product range by 60%. Tesco, the UK’s largest supermarket, recently committed to boosting sales of meat alternatives by 300% within five yearsby 2025.

The number of Americans identifying as vegan rose 600 percent between 2014 and 2018 (from one to six percent), according to a report by research firm GlobalData, while in the UK a survey by The Vegan Society showed an increase of 350 percent. However, in Australia, the third fastest-growing vegan market in the world, the number of food products carrying a vegan claim increased by 92 percent in that time. Surprisingly, it a Middle Easter nation, , that’s earned them the nickname of the “Vegan Nation”.

More than 5% of Israel’s population claims to be vegan and the country’s -friendly culture and its plethora of plant-based cuisine options has made it one of the world’s vegan capital. The GCC states aren’t too far behind either. For a region where consumers have some of the highest per capita meat consumption rates, Saudi Arabia consumes a total of 64kg of meat per person, while the UAE with 59kg per person according to a report from AT Kearney. One would assume the revolution hasn’t quite progressed there yet. However, that’s not entirely true.

Globally the push towards veganism is due to ethical and environmental concerns, but in this region, especially Saudi, more people are seen moving towards the vegan lifestyle to promote better health. Either ways, what’s happening today is a whole diet and lifestyle shift, which brands and retailers have no choice but to capitalize on. In fact, the world’s largest plant-based chain is a Dubai-based restaurant that goes by the name of Veganity. Well, it shouldn’t quite come as a surprise given the city’s idee fixe with all things superlatives – biggest, highest, tallest.

But it’s not just the vegan market that retailers need to keep an eye out for. What’s also gaining popularity is the alternative meat market (which some pure vegans oppose), which has managed to garner more mass appeal, especially to the meat-eating natives.

Market research company Triton expects an additional upsurge in the Middle East and African vegan meat market in the coming years. It predicts a compound annual growth rate (CAGR) of 9.84 percent between 2019 and 2027.

Amongthe major players in the Middle Eastern Vegan market include Beyond Meat, VBites, Cauldron Foods, and Tofurky with some mainstream fast food chains, cosmetic brands, standalone cafes and restaurants, as well as hypermarkets and supermarkets jumping on the bandwagon.

The fact that some of the most influential people in the region are also actively participating in this revolution just adds brownie points to the whole process. Prince Khalid bin Alwaleed, for instance, is investing in companies like Beyond Meat, biotech start-up TurtleTree Labs and animal-free Bond Pet Foods apart from launching Folia, his plant-based menu project across the GCC and wider Middle East last year.

Supermarkets, department stores and GCC-based digital marketplaces have had to actively make this shift and the ones that have had a head start on keeping up with this ‘green trend’ have reaped the benefits of it, especially this year.

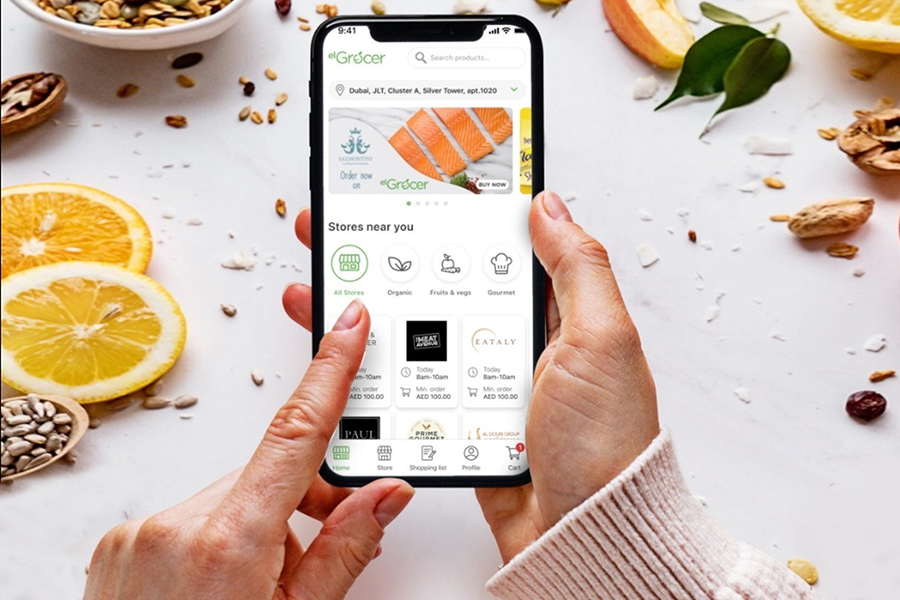

elGrocer

UAE-based elGrocer, one of the region’s most popular e-grocers that is part of the $2 billion online grocery delivery market,can be studied as an interesting case that showcases the vegan revolution that the region is going through today.

elGrocer has seen a growing shift in demand for vegan products on its platform and expects to see a further rise in both people shopping for vegan products as well as the products offered by supermarkets and specialty stores. So far, it has seen a 300% rise in monthly sales of vegan products both pre and post COVID, an 1152% rise in sales in 2020 over 2019.

“We’ve seen our consumers adapting more to the vegan lifestyle. We’ve witnessedretailers increasing their vegan categories and increasing the number of products in their Stock Keeping Units (SKUs) and as a result we’ve also seen a significant growth in sales and consumer demand”, said Raed Hafez, CEO of elGrocer.

In line with market trends, elGrocer has added several stores that offer vegan options like Marks & Spencer, Jones the Grocer, Bid Food, Organic Food & Café and Skinny Genie among others.

“We’ve got hypermarkets, supermarkets and specialty stores. Almost all retailers have some vegan or plant-based products. Year-on-year, we’ve seen over 1100% growth in sales just on the vegan category. So when we say significant growth we really meant it”, he said.

However during the initial months, the products that were in demand weren’t particularly the healthy kind.

“During the lockdown we saw people moving towards the unhealthy lifestyle. We saw a sudden increase in snacking, confectionaries etc”, he said.

But soon after, they started being more diet conscious and following nutritious and healthy diet trends, along with trying more vegan options. As a result, when elGrocer compared their sales in February against May, they witnessed a 300% increase in sales of vegan products.

“The top category in high demand remains to be vegan cheese and there are a lot of other related elements that are getting more interest in demand”, said Hafez. It comes as no surprise as the vegan cheese market alone is expected to register a substantial CAGR of 7.96% in the forecast period of 2019-2026.

While elGrocer hosts a range of global brands on its website and app, there is a growing demand from consumers that the homegrown brands can cater to. The platform has even modified their search algorithms such that people are no longer just given the option of searching for a product by its name, but by lifestyle options too.

“I think there is a local demand and regional demand for the vegan brands so the local players are not going to be far behind. How elGrocer differentiates is by creating space for a lot of specialty stores. We have specialty stores that are locally founded startups and they are creating their own version of vegan and healthy products – Skinny Genie is one of those. I wouldn’t be surprised to see all the local brandsmaking sure that they don’t miss out on this new healthy trend”, he said.

The ultimate plan for elGrocer in this sphere is to update their user experience by movingto sustainable packagingand making sure that physical stores for vegan friendly products exist.

During Covid-19, the e-grocery market overall has seen a strong surge. In the UAE, the market has grown by 300% in the third quarter of this year and is now worth $1.1 billion, while Saudi Arabia’s market has grown by 500 per cent to $530 million. Overall in MENA the e-grocery market is currently worth $2 billion and accounts for 12 per cent of e-commerce.

Notifications