The long-term fundamentals GCC retail sector, which is experiencing a slowdown currently, remain strong and are expected to grow steadily through 2021, indicates Alpen Capital in its latest report on the GCC Retail Industry.

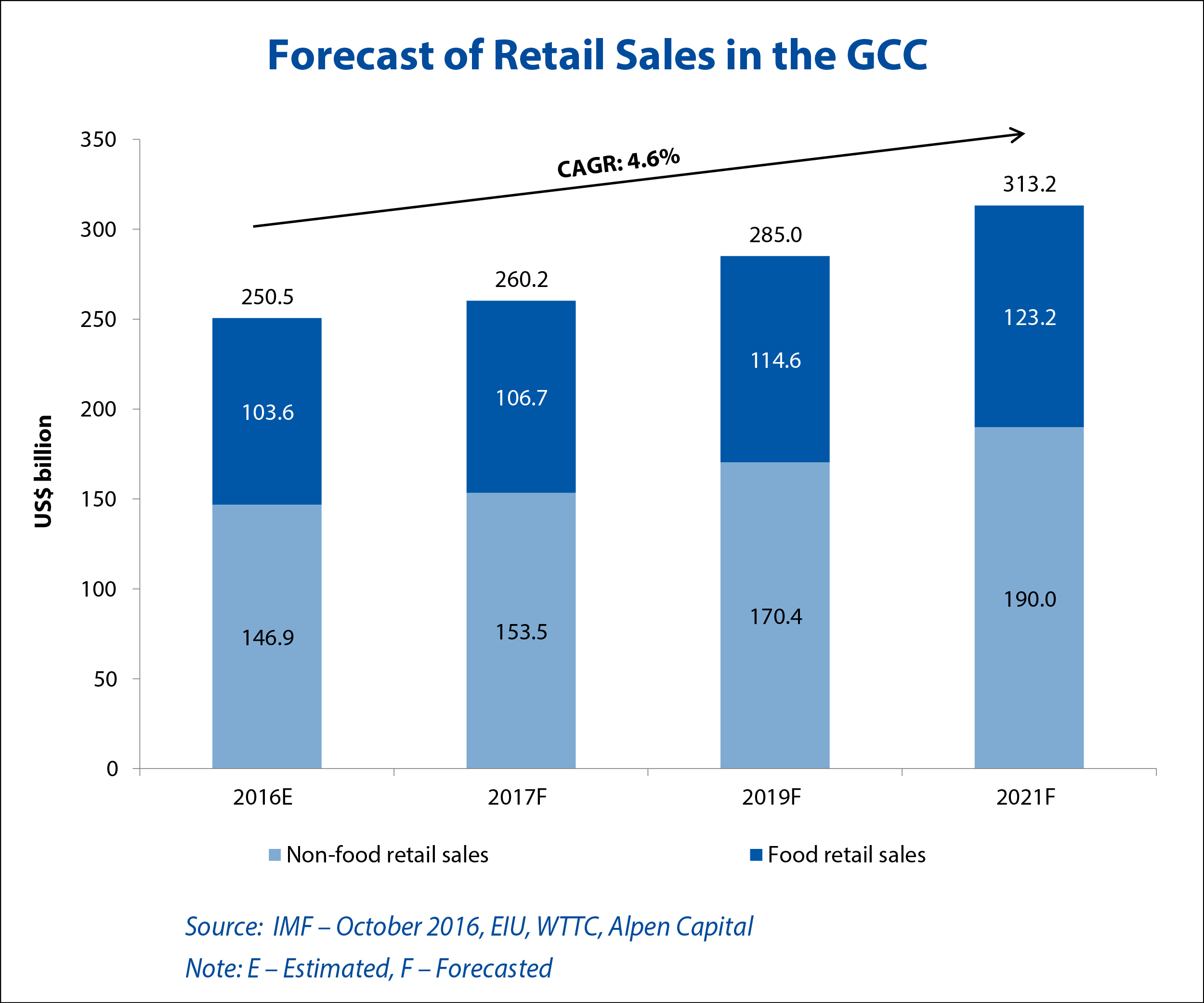

According to Alpen’s report, the size of the GCC retail sector is set to grow at a CAGR of 4.6% from $250.5 billion in 2016 to $313.2 billion in 2021. After witnessing a drop in 2016, retail sales are likely to grow at a slow pace in 2017, in view of the prevailing economic environment. Nevertheless, the sector is expected to recover in 2018 and grow steadily through 2021 driven by the expected rise in population, international tourist arrivals and per capita income.

GCC retail sales

Between 2016 and 2021, non-food retail sales are likely to grow at an annualised rate of 5.3%, led by an increasing number of youngsters and expatriates, who are propelling demand for innovative, trendy and international consumer products. During the period, food retail sales are likely to grow a CAGR of 3.5%, driven by the expanding consumer base and demand for health foods.

The GCC population is expected to grow at an annualised rate of 2.3% between 2016 and 2021. An expanding consumer base, comprising a high proportion of young and working-class, is the major growth driver for the retail sector. GDP per capita (at current prices) in the GCC is projected to expand at a CAGR of 4.3% during the forecast period and is also likely to drive the growth of the sector. Going ahead, an anticipated recovery in economic conditions is likely to boost consumer sentiments and spending.

Country-wise retail sales

During the forecast period, total retail sales in the GCC countries are set to grow in the range of 3.3-5%. Saudi Arabia and Bahrain are expected to register the fastest growth, driven mainly by an increase in tourism activity and per capita income.

Supermarket and hypermarket sales

Sales generated by at supermarkets and hypermarkets are projected to grow at a CAGR of 4.3% between 2016 and 2020.

E-commerce sales

The retail e-commerce market in the GCC is expanding, given the increasing use of internet and social media, better access to secure payment gateways and gradual improvement in the delivery system, says the report.

The region’s e-commerce sale is expected to reach $41.5 billion by 2020. The UAE is the largest online retail market in the GCC with a market share of 53%, followed by Saudi Arabia (14%), Oman (12%) and Qatar (10%). As demand increases, the region is likely to see the emergence of new e-tailers and revamp of online portals by traditional retailers

Airport duty free sales

During the period, airport-based duty free sales in the Middle East are projected to grow at an annualised average of 7.9% in anticipation of an increase in passenger traffic at the international airports.

Tourist inflow will continue to rise, as the region is witnessing a spate of infrastructure and tourism-related developments. The mega events of World Expo 2020 in Dubai, 2022 FIFA World Cup in Qatar as well as the increasing number of pilgrims to Saudi Arabia will have an impact on tourist arrivals in the region and boost the retail sector.

“The GCC retail sector continues to remain an active contributor to the region’s economic development. Favourable demographics, high per capita income and a strong tourism industry have attracted well-known international retail brands to the GCC. Changing consumer preferences and the proliferation of digital devices are further reforming the region’s retail landscape. The numerous mall developments in the pipeline and growing penetration of modern store formats are a testament to the immense opportunities in the sector,” says Sameena Ahmad, managing director, Alpen Capital.

“Though the GCC retail sector has been under pressure for the last couple of years, it is poised to grow at a moderate pace in light of stabilisation of oil prices and economic revival, expanding consumer base, increase in tourist arrivals, mega international events and a growing e-commerce market. On the supply side, we see a huge scope of retail penetration as most of the cities in the region have a low retail GLA per capita compared to the developed countries,” adds Mahboob Murshed, managing director, Alpen Capital.

Notifications