Sunil Kumar and Ali Saeed Juma Albwardy, Spinneys

One of UAE’s leading fresh food retailers, Spinneys has announced its intention to proceed with an initial public offering (IPO) and list its ordinary shares for trading on the Dubai Financial Market (DFM).

Ahead of the IPO announcement, Spinneys was re-registered to a public company limited by shares on March 29, 2024 from Spinneys 1961 Holding plc which was incorporated as a private limited company pursuant to DIFC Law No. 5 of 2018.

Commenting on the IPO, Ali Saeed Juma Albwardy, Founder and Chairman of Spinneys, stated, “Having begun our story in Dubai in the early 1960s, we are proud to be taking another significant step in our journey. Spinneys is a long-standing brand with a strong heritage in the UAE and a commitment to quality, evolving over the decades to become one of the country’s leading premium fresh-focused food retailers. Ours is a brand with huge ambition, positioned to flourish in the GCC’s most attractive and fast-growing markets. Our IPO represents an opportunity for investors to be part of our next stage of growth and we are excited to embark on a new chapter, bringing our fresh opportunity to a wider shareholder base.”

Before getting into the IPO piece, here’s a quick look at how Spinneys has evolved its brand positioning, while building a formidable presence in the UAE. A lesser known, and perhaps a fun fact, is that at the time of launch in Dubai, Spinneys was locally known as ‘The Frozen Chicken’ brand – the only retailer to sell frozen chickens from a chiller van. Over the decades the brand has evolved significantly, building a solid reputation for offering high quality and fresh products, operational excellence and active community engagement.

“Over the years, we have expanded our business to operate one of the leading premium brands across 75 locations in the UAE and Oman, focused on high-quality fresh food and exceptional customer service. Spinneys has a presence in some of the most vibrant, fast-growing and resilient countries in the region and we aim to continue to capitalise on supportive macroeconomic tailwinds. We have a proven track record for growth, driven by the expansion of our store network, increasing online penetration, a growing private label offering and a vertically integrated supply chain, resulting in robust financial performance with a track record of like-for-like growth and strong margins. We have much to be excited about this year as we celebrate the 100th anniversary of the Spinneys brand in the region, with plans to enter the thriving Saudi market, where we see immense potential for our business. As our group grows, our purpose remains unchanged: to nourish and inspire our communities to live better lives, day-by-day,” said Sunil Kumar, Chief Executive Officer of Spinneys.

Spinneys at a Glance

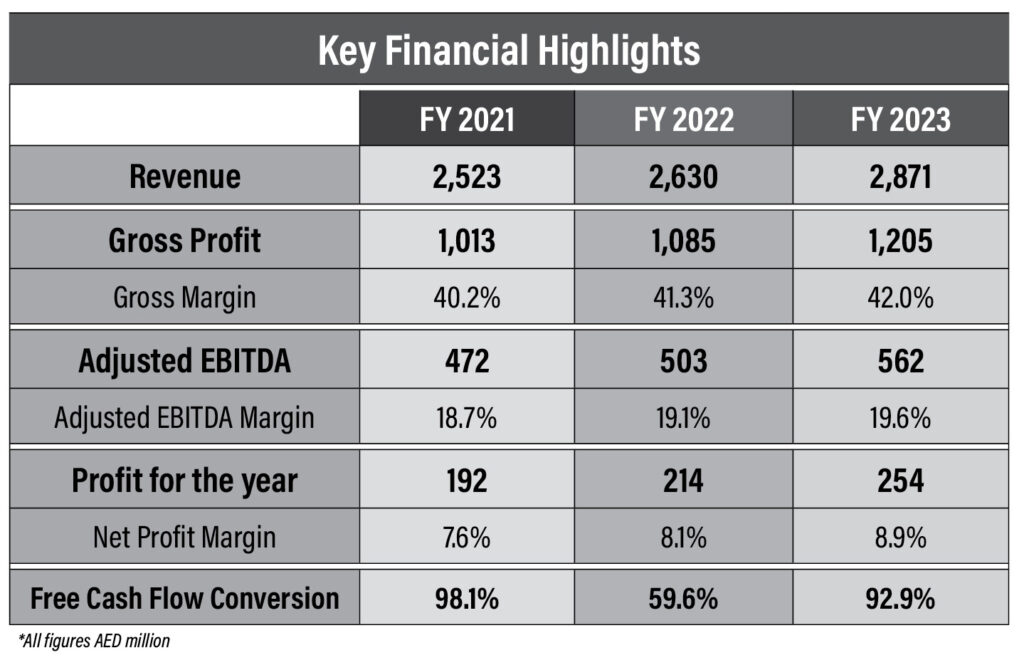

Robust financials supporting Spinneys’ growth strategy

For starters, in 2023 Spinneys’ revenue grew to AED2.87 billion, at a CAGR of 8.2% from 2019, driven by increasing online penetration, increasing private label penetration, successful navigation of inflation through strategic pricing and an expanding store footprint in the UAE. Spinneys’ gross profit margin grew from 40.2% in 2021 to reach 42%. Profit for the year 2023 stood at AED254 million, having grown by 18.7% from 2022.

Looking ahead, realisation of the Group’s growth potential would be enabled by strategic drivers including: (i) like-for-like growth; (ii) UAE whitespace; (iii) Saudi whitespace; (iv) The Kitchen, by Spinneys concept launch; and (v) operational efficiencies. Spinneys has identified key grocery market and Group-specific drivers of like-for-like growth, including a projected 3.9% CAGR in the UAE grocery market from 2022 to 2028. In addition, supporting factors include the robust growth potential of the UAE foodservice market projected to grow at a CAGR of 6.8% from AED29 billion in 2022, to reach AED43 billion by 2028, and the Saudi grocery market projected to grow at 4.8% CAGR across the same period.

Meanwhile, Spinneys plans to commission a new production facility in 2027 in the Dubai Food Tech Valley, in line with the UAE’s National Food Security Strategy, combining the capabilities of its two existing production facilities and growing the share of own-produced SKUs by entering new categories. The company also aims to increase private label participation with improved sourcing and increase self-sufficiency with plans to invest in sourcing capabilities in Europe.

Key Financial Highlights

Over to IPO: What we know, so far

The company has recently announced its intention to proceed with an IPO, listing its ordinary shares for trading on the DFM. Some key highlights of the IPO include:

More on the capital structure and dividend policy

The share capital of the company, as at the date of the listing, has been set at AED36,000,000 divided into 3,600,000,000 shares paid-in-full, with the nominal value of each share being AED0.01.

Following the offering, and starting from the fiscal year 2024, the company intends to pay dividends on a semi-annual basis in April and October of each year, with the first payment targeted for October 2024, in respect of H1 2024.

For the fiscal year 2024 and the years thereafter, the company will endeavour to maintain a dividend pay-out ratio of 70% of annual distributable profits, after tax.

The dividend policy is designed to reflect the company’s expectation of cash flows and expected long-term earnings potential, while allowing Spinneys to retain sufficient capital to fund ongoing operating requirements and continued investment for long-term growth.

The dividend policy is subject to consideration by the Board of Directors in relation to the cash management requirements of the company’s business for operating expenses, and anticipated capital expenditures and investments. In addition, the company expects that the Board will also consider market conditions, the then current operating environment, and the Board’s outlook for business and growth opportunities.

Factors fuelling long-term growth

In summation, here are some factors likely to drive long-term growth for Spinneys.

Demand for premium food products:

Extensive fresh food range:

Exceptional local execution, supported by well invested, vertically integrated operational and supply chain capabilities:

Well tenured, experienced leadership:

Elevate engagement, experience and profitability to unlock retail growth

Marchon Eyewear’s ZEISS wins 2024 Red Dot “Best of the Best” Awards for VisionClip

Revolutionising retail: How RetailGPT is shaping the future of shopping malls

Times Square Center: Building community through more than retail

You must be logged in to post a comment.