Shopping while earning money or getting returns from a part of your bill – sounds like a win-win deal isn’t it? Cashback websites reward customers when they shop online by returning them a percentage of what they spend when they purchase. This has been a growing trend amongst retailers and consumers, offering the former increased revenues and the latter some future savings. Infact incentivised cashback have seen tremendous growth in the past few years. According to Statista, the global cashback industry is expected to be worth more than $200 billion a year by 2024, with statistics showing that 46% of cashback participants consider it a vital step in their purchase decisions. 43% of affiliate marketing placement was sold to cashback and loyalty partners in 2019. Moreover, there has been sales revenue growth from this channel of affiliate increase by over 200% between 2018 – 2019. As per the same research, retailers who have participated in cashback grew their revenue up to two and a half times faster than competitors who do not use them while generating 100-400% higher returns 3 to their shareholders.

In a consumer-driven marketing scenario, discounts mostly drive seasonal or selective customers. However, discounts do not encourage a repeat visit. Firstly, businesses are always unsure if the same customer will walk in the second time. Secondly, customers get used to discounts on the bill and the moment brands remove discounts from the equation, customers feel that they are overpaying for a product. “On the other hand, since cashback can be used to off-set the bill back on the next visit, it basically represents future savings. They not only encourage a repeat visit, but builds a habit of paying in full. Customers pay the full bill amount at first, and then they get instant cash back into their accounts which they can redeem when they visit the same business a second time” said Uday Rathod, Founder of ZNAP.

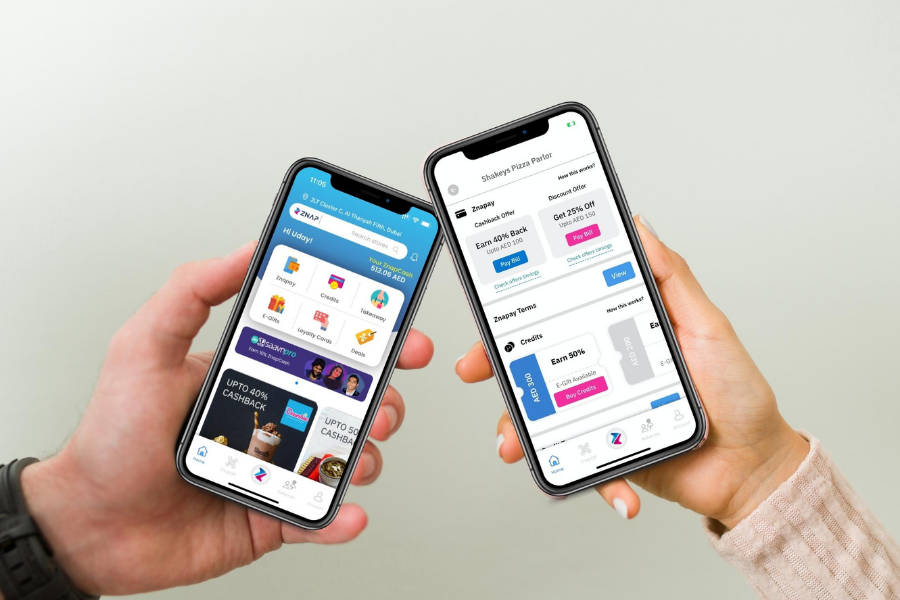

ZNAP is a fintech platform born in the UAE providing smart payments to local businesses and helping customers stack up your rewards via a simple secure user friendly app . It uses features such as Znapay ( Cash Back Or Discount ) and Credits (Self Use & Egift) to help local businesses be discoverable to the modern digital consumers. “We don’t just facilitate payments but also link up Cashback on every transaction that can be used back in the next transaction. We currently have over 300++ partnered merchant portfolios across F&B, Health and Beauty, Fashion and many more categories to chose from”, confirmed Uday. With a surety of repeat customers, retailers are also willing to pay a higher percentage of cash backs over discounts. Hence, Cashbacks realistically is a more effective consumer marketing model for a business’s ROI and brand loyalty.

Consumers receiving cashback payments are not only more likely to buy again from the same company, but once they do, they increase the size of their future purchase. One motivation for this can be financial: consumers with liquidity problems postpone spending until they receive cashback payments and have more money at hand.”We feel Cashback is a more powerful tool to drive loyalty and revenues for brick and mortar stores and these strategies yields more financial benefits for retailers. A customer is likely to visit a business three to six times a month depending on the services offered and a cash back % provided. Since, cash back encourages the customers to visit a business more frequently to redeem the cash back; it over the time converts into regular sales and financial benefits for retailers. This is the reason why retailers are more keen on offering higher percentages of cash backs than discounts”, revealed Uday.

Retailers can easily optimise with a wide range of cashback sites via their affiliate program. The advertiser would need to accept the cashback partner to their program, and once approved, they will integrate the advertiser onto their site. Once integrated, the advertiser will be active on the cashback site for shoppers and large member bases to engage with. Cashback payments impact purchasing behaviour differently depending on the type of retailer. Point reward system offers quite a poor conversion ratio. Eg: In most of the cases, customers get points equal to the bill amount and 100 points will convert into AED 1, which means that customers earn only 1% on their spends via the point system. “On the other hand, with ZNAP’s cash back model, customers can earn up to 50% real value cash back on their spends with partner merchants. Since, cash back encourages repeat customers, the local businesses tend to give higher reward percentages to the users than the traditional points structure.Additionally, ZNAP empowers businesses to offer higher cash back during slow/off-peak business time, typically weekdays when walk-ins are low, stated Uday.

The concept of cashback gained mainstream traction in 1986 when Discover Financial Services, a division of Morgan Stanley, launched a credit card with no annual fees, a higher-than-normal credit limit, and a cashback bonus on certain purchases. In most cases, Cashbacks are only provided via credit cards as a part of a promotion for customers who are eligible or who can afford the same based on the monthly income brackets. However, ZNAP gives a FREE platform for any users who can take advantage of Cashback with any debit/credit card regardless of the brand or type of cards. Giving the power of saving right into the customers hands”, concluded Uday.