What will the closets of the future look like? Will it be on-trend and fashionable enough, at the same time consciously curated?

Almost a decade ago, I came across the concept of ‘renting a wedding dress’, as a friend chose this option. The logic was simple – an expensive wedding dress would lie in her closet forever. The idea was novel and quite like-able.

Around the same time in 2009, a clothing rental company in the US called Rent the Runway was being launched. Co-founder Jennifer Hyman’s sister had bought a designer dress for a wedding party that almost led her into a credit card debt. Hyman thought of a business idea that would let women rent clothes instead of buying. Thus, came about Rent the Runway.

Cut to the present, a section of consumers is seriously heeding Marie Kondo’s advice to only hold on to things that ‘spark joy’.

Consumer’s changing consumption patterns – as they are rethinking ownership – and concerns about the environment have indeed added the necessary fillip, leading to a burgeoning fashion resale market. While resale/pre-loved/pre-owned market accounts for only a small portion of the overall global apparel market, analytics firm GlobalData predicts the fashion resale market to touch $50 billion by 2023.

Some notable examples:

GAP Inc has collaborated with fashion resale platform thredUP, supporting its resale-as-a-service model, allowing its customers to trade in second-hand clothes against shopping credit to be redeemed at any of its brands.

Nordstrom’s has launched a ‘re-commerce experience’ through See You Tomorrow, which offers a carefully curated selection of pre-owned apparel and accessories.

Back to Rent the Runway, it has slowly but surely increased its reach and breadth of offerings through like-minded collaborations, the most recent with West Elm for furniture rental. It has also rolled out a rental service for children’s wear.

Game changers from the Middle East

Closer home, brands like RETOLD and The Luxury Closet are pioneering the fashion and luxury resale markets. While RETOLD is encouraging people to dress up but sustainably, The Luxury Closet has been firm on its commitment to democratise luxury by opening up closets stacked with luxury goods.

RETOLD

Since RETOLD opened in January 2018, it has ‘rehomed’ over 20,000 items. Its product mix comprises 55% high-street, 37% designer and luxury, 4% vintage, 4% children’s and babies and 1% menswear. “We stock over 8,000 pieces at any one time, and regularly turnover at least 20% each month; so, there is always more arrivals every day. Around 20% of our stock is brand-new with original tags. Our most popular brand is Zara. However, anything from DVF, Missoni, Chloe and Vivienne Westwood, to name a few, get sold almost immediately,” shares Sian Rowlands, chief storyteller & founder of RETOLD.

RETOLD built a strong community of both sellers and shoppers, often converting one to the other. As an independent store not located in a shopping mall, it has been challenging for RETOLD to find new footfall. “But since we opened, we have welcomed over 7,000 unique customers with more than 50% returning. And our conversion rate is 80% conversion rate,” said Rowlands.

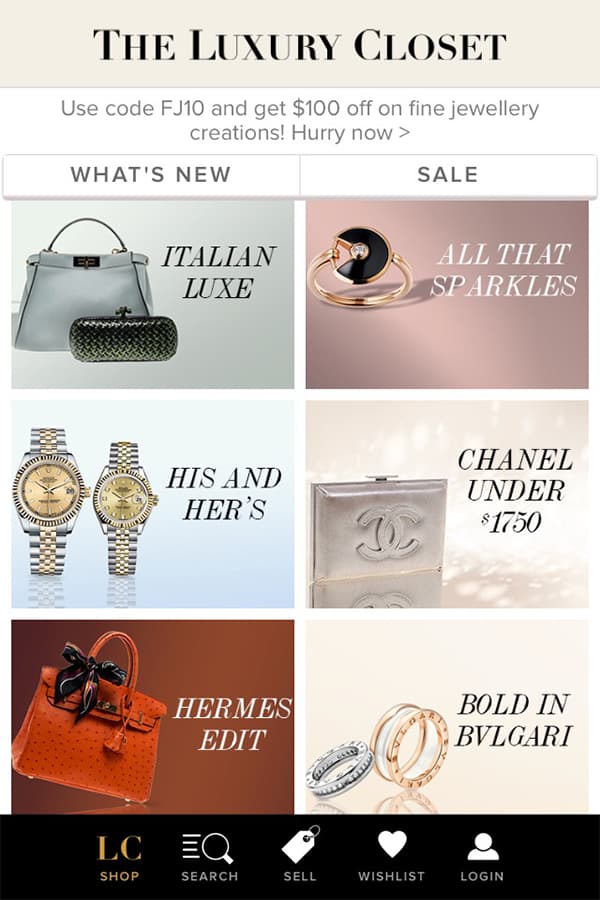

The Luxury Closet

On its part, The Luxury Closet has built a coveted catalogue of pre-owned luxury goods. “In 2019, we achieved remarkable milestones, such as going global with our launch in Hong Kong alongside our expansion across MENA. We are delighted that the market is moving towards the direction of re-homing luxury goods and supporting our incredible business model that not only helps consumers financially but supports the sustainability movement and protecting our future,” states Kunal Kapoor, founder & CEO, The Luxury Closet.

Since its launch in 2012 as a luxury e-commerce marketplace, The Luxury Closet has been focused in two different areas – seller side to expand the supplier base and gather the best supply and the buyer side creating innovative campaigns and special sales.

“Over 50% of millennials consider resale value of a luxury item and 64% are influenced by the sustainability movement before purchasing a premium item. This coupled with the fact that pre-owned items are priced 60% less than retail prices, it creates a very attractive proposition for customers,” observed Kapoor.

However, Rowland feels the fashion industry, as it stands, is fragmented. “There will be no quick fix, and it will require many changes in many different areas of the industry. From using innovative and sustainable materials, to closing the loop on the supply chain, from reducing wastage during the manufacturing process, to ensuring transparency from brands, from demanding adequate working environments for the workforce to localising retail – the list is endless.” According to her, increasing the “resale” offer will be an integral part of improving the fashion industry as a whole.

On that note, let the closets of the future spark joy.