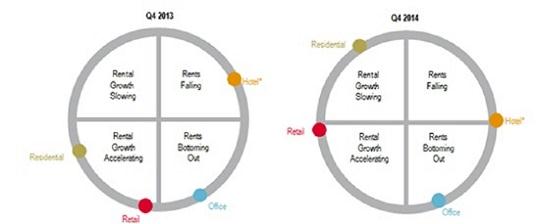

Jones Lang LaSalle (JLL) has released its fourth quarter (Q4 2014) Riyadh Real Estate Overview report that asses the latest trends in the retail, hotel, office and residential sectors in Saudi Arabia’s largest city.

Commenting on the Riyadh market report, Jamil Ghaznawi, national director and country head of JLL KSA, observes, “Confidence in the retail market remains strong as reflected in the announcement of various new shopping centres, positively effecting rental growth figures. Supply increases in the hotel sector that showed occupancy rates were improving and average daily rates remain under downward pressure. While in the office sector, new supply has constrained performance and increased vacancies. In the last quarter of 2014, we have also witnessed the introduction of new mortgage regulations requiring a 30% down payment on all home financing; this has restricted growth levels in the residential market.”

The retail segment saw no new completions over the last quarter, as only smaller retail centres were delivered – for example Meem Plaza. Rents have slightly increased in regional and community shopping centres, whereas super regional malls saw no increase. Vacancy levels in major malls have slightly decreased (-1%) during this quarter. Delays in the KAFD and ITCC projects have resulted in their retail components being pushed back into 2015 and beyond.

“The Saudi real estate market is heavily dependent upon high levels of government spending and while the more prudent approach is unlikely to have an immediate impact on the market in 2015, it certainly marks the end of a period of rapid increase in spending, which could constrain the growth of the real estate market in the longer term,” adds Ghaznawi.