Two-thirds, or 66%, of retail associates surveyed by Zebra Technologies Corporation believe that if they are equipped with tablets, they could provide better customer service and improve the shopping experience. Zebra undertook the survey as part of its 11th annual Global Shopper Study, which analyses attitudes, opinions and expectations of shoppers, retail associates and retail decision makers.

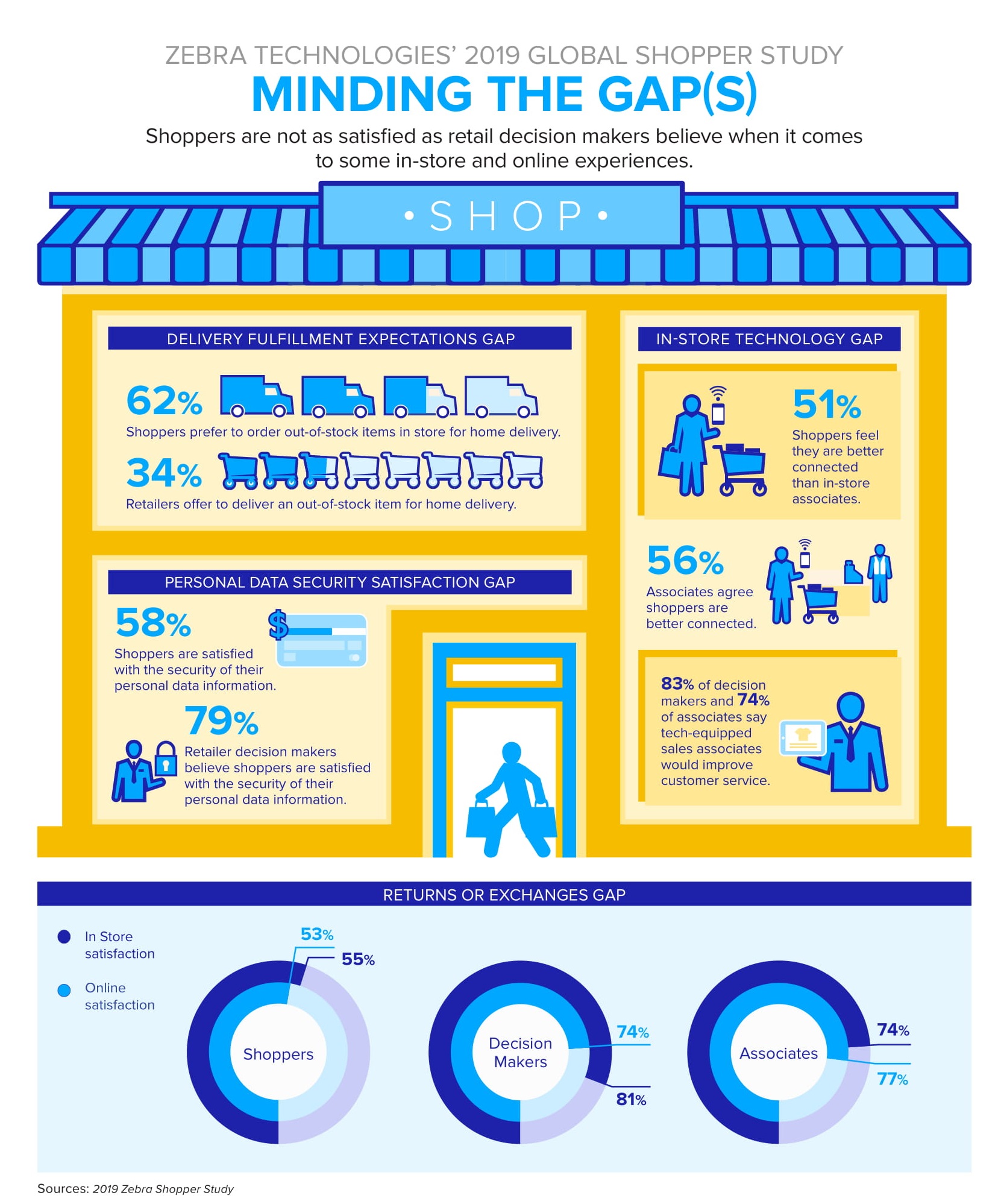

More than one-half of shoppers, 51%, believe they are better connected with their smartphones than store associates. Retailers are investing in edge technologies to combat this gap. Nearly 60% of retailers plan to increase their spend on handheld mobile computers by more than 6%, and more than one-in-five retailers, 21%, plan to spend greater than 10% on rugged tablets over the next three years.

Fifty-five percent of surveyed retail store associates agree that their company is understaffed, and nearly one-half, 49%, feel overworked. Store associates cite frustration with their inability to assist customers as 42% find they have little time to help shoppers because of pressure to get other tasks completed. Another 28% claim that it’s difficult to get information to help shoppers. Most surveyed retail decision makers, 83%, and store associates, 74%, concur that shoppers can have a better experience with technology-equipped sales associates.

Meanwhile, only 13% of surveyed shoppers completely trust retailers to protect their personal data, the lowest level of trust among 10 different industries. Seventy-three percent of surveyed shoppers prefer flexibility to control how their personal information is used.

“Our study reveals shopper expectations are on the rise. While retailers are addressing fulfilment challenges, they also need to provide a more trusted, personalised shopping experience that gives customers what they want, when, where and how they want it,” says Jeff Schmitz, senior vice president and chief marketing officer, Zebra Technologies.

The study also identified diverging expectations on the impact of automation between retailers and store associates. Nearly 80% of retail decision makers – compared to 49% of store associates – agree that staff checkout areas are becoming less necessary due to new technologies that can automate checkout. Also, more than one-half of retail decision makers, 52%, are converting point-of-sale space to self-checkout, and 62% are transforming it for online order pickup.

In the Middle East and Europe specifically, 74% of decision makers agree that increased e-commerce is driving more interest in fulfilment solutions and warehouse investments. More than three-quarters, 76%, of retail decision makers agree that accepting and/or managing returns of online orders is a significant challenge.