The number of retail visitors has gone up significantly in the UAE despite decline in oil prices and global economic uncertainties, indicates a market study conducted by Sàvant Data System, a Dubai-based solutions and services company providing business intelligence (BI) to the retail sector in GCC.

In 2016 the UAE accounted for the highest retail and mall visitor distribution in the GCC, largely owing to consistent efforts by the government to attract tourists and shoppers. Overall, the number of mall and retail visitor distribution in the GCC rose last year compared to 2015.

“It is a positive story for the region. There has been a rise in visitors by 5.8% as compared to 2015 (within the SDS retail client base). While the figures are reassuring, it is important that the retailers see this change of footfall and form pull strategies to widen their business. Having said that it is important to understand consumer behaviour and changing trends and customise their strategies accordingly,” says Vic Bageria, CEO & CVO of Sàvant Data System.

UAE & Saudi Arabia attract maximum retail visitors

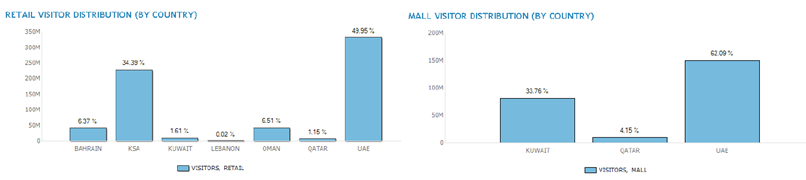

The UAE has accounted for nearly half of the total retail visitor distribution with a whopping share of 49.95%, while Saudi Arabia took the second spot accounting for 34.39% of the total footfall.

Dubai itself attracted 171,568,575 visitors i.e. 25.8% of the total retail visitor distribution, indicates the Sàvant Data System research. Abu Dhabi attracted 67,944,386 visitors i.e. 10.2% of the total retail visitor distribution, which is majorly a result of Abu Dhabi’s recent development plans – including the Etihad Rail Project worth AED40 billion – to facilitate smooth mobility and hassle-free trade.

Qatar and Lebanon, on the other hand, accounted for the lowest percentage of retail visitor distribution, 1.15% and 0.02% respectively.

UAE malls pull significant footfall

The mapping statistics released by Sàvant Data System for a GCC malls revealed that the UAE is, yet again, the most sought after region for mall visitors, accounting for 62.09% of the total mall visitor distribution, followed by Kuwait and Qatar with 33.76% and 4.15%, respectively.

The UAE remains the top shopping destination as it continues to add more retail spaces like the Springs Village mall and the Emaar Malls’ new shopping spaces coming up at the Dubai Creek Harbour and Dubai Hills Estate. In Abu Dhabi mall developments include the Reem Mall worth $1 billion, Al Maryah Central worth $409 million, Al Falah Mall worth $239 million and Saadiyat Island worth $200million.

While Kuwait recently opened its Al Kout Mall by Tamdeen Group boasting of 260 outlets, Qatar is all set to open nine malls this year – including Al Hazm Mall, Doha Mall, Katara Mall, Al Mirqab Mall, Tawar Mall, Doha Festival City, Northgate, Place Vendome and Marina Mall.

Further, with Majid Al Futtaim’s recent rise in revenue, it is set to keep its developments in Egypt – he City Centre Almaza and Mall of Egypt – on track.

Notifications