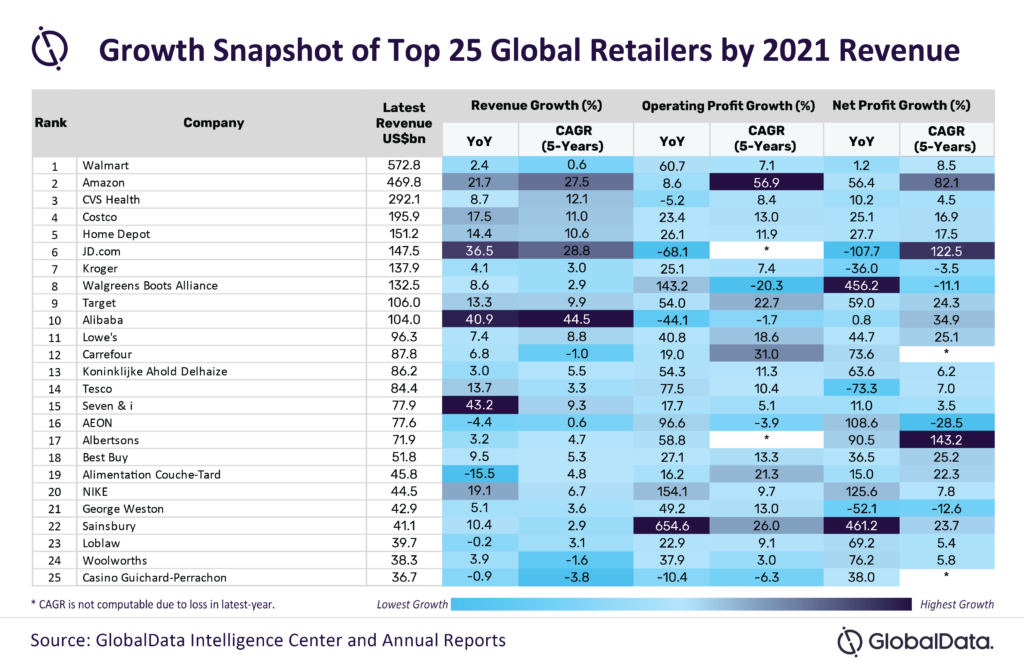

Half of the top 25 publicly traded global retailers reported more than 8% year-on-year (YoY) growth in revenue despite pandemic-related challenges, according to GlobalData. Retailers worldwide were able to quickly adapt to Covid-19 challenges by swiftly improving e-commerce options. Meanwhile, pharmaceutical retailers and home improvement/gardening supply retailers also benefitted from lockdowns.

“All 25 of the retailers we tracked implemented measures to expand their business operations during the COVID-19 period. Major online merchants such as Amazon, JD.com and Alibaba gained a revenue growth of above 20% in FY2021. Further, they saw a compound annual growth rate (CAGR) of more than 25% during the 2017–2021 period, driven by a significant increase in the number of annual active customers as buyers preferred to shop online,” said Divya Vootkuru, Business Fundamentals Analyst at GlobalData.

According to GlobalData’s ranking, pharmaceutical retailers CVS Health and Walgreens Boots Alliance (Walgreens) saw 8% revenue growth in 2021.

“The impressive growth seen by these pharmaceutical retailers resulted from an increase in the consumption of prescription drugs, the release of new pharmaceutical products, and the successful distribution of COVID-19 vaccines,” she said.

GlobalData also notes that home improvement and gardening supply retailers saw positive growth in operational and net earnings, including Home Depot (more than 7%) and Lowe’s (more than 20%).

“A survey by GlobalData reveals that 59.8%** of UK consumers used their extra time during lockdowns to refresh their homes, with 29.5% buying new homeware and 13% buying new furniture. The most popular was the study/office, as people prepared their desks to work from home, but dining rooms and living rooms also got a spruce up. It wasn’t just new homeware, though, as 74.9% of respondents said they intended to undertake some DIY at home—greatly benefitting retailers such as Lowe’s and Home Depot,” she added.

Of the top 25 retailers, Seven & I was the only retailer to report double-digit revenue growth, at 43.2% YoY and 9.3% CAGR. This was achieved via increased sales in overseas convenience store operations, largely driven by 7-Eleven’s acquisition of Speedway. Meanwhile, JD.com was the only major player to record a YoY decline of over 60% in operating profit and net profit, and Couche-Tard saw the largest YoY loss in revenue and a decline of more than 15%.

“Other big gainers were Walmart, Walgreens, Target, Ahold Delhaize, Tesco, Sainsbury’s, Nike, Albertsons and AEON, which all reported more than 50% growth in their operating profits. In terms of profitability, 70% of the top 25 retail companies reported positive YoY growth, with three companies (Nike, Sainsbury’s and Walgreens) recording more than 100% growth.”

In the fiscal year 2021, over 80% of the top 25 retail companies reported YoY growth in their net profits, with 11 retailers recording more than 50% growth. Higher revenue and improved operational performance, as well as reduction in expenses, led an increase in the net earnings of Walgreens, Sainsbury, Loblaw, Costco, Best Buy, Carrefour, Ahold Delhaize, Amazon, Aeon, Kroger, Woolworths, Nike, and Albertsons.

“Drastic improvement in e-commerce enabled global retailers to focus on customer-centric and digital initiatives. Now, more retailers will be developing new business models to support consumers in contactless communication infrastructure, as well as implementing digital supply chain management to further streamline and expand business operations,” she concluded.

Elevate engagement, experience and profitability to unlock retail growth

Marchon Eyewear’s ZEISS wins 2024 Red Dot “Best of the Best” Awards for VisionClip

Revolutionising retail: How RetailGPT is shaping the future of shopping malls

Times Square Center: Building community through more than retail

You must be logged in to post a comment.