The scale of the pandemic has significantly impacted the social mobility. In turn, there will be a far-reaching impact on global and regional economic growth. Despite the effect on economic activity, the UAE real estate market is well-positioned for a bounce-back with investment expected to return to pre-pandemic levels by 2021, according to the Real Estate Market Outlook H1 2020 for the UAE, by CBRE.

Whilst CBRE expects the economy to begin to bounce-back in H2 2020, the pandemic’s effects were so strong in H1 2020 that the year will still register a contraction of economic activity. It estimates that Abu Dhabi’s GDP will contract by 7.2% in 2020, and begin recovery in 2021, supported by an AED 3 billion stimulus package that includes initiatives such as subsidies, rebates, and financial support. In parallel to this, the Government of Dubai has a similar stimulus package of AED 1.5 billion to support various sectors.

“There are three key challenges to recovery: subdued consumer demand; lower disposable income, and restrictions in occupancy of retail and commercial space. These, in turn, are impacting the real estate sector, which is having to adapt and evolve to the ever-changing demands of the pandemic,” says Dima Isshak, senior manager, CBRE.

Residential transaction activity decreased by 20% in H1 2020 vs H1 2019, primarily due to lockdown measures and travel restrictions to combat the spread of COVID-19. As these restrictions have eased, developers and landlords are increasingly offering a range of incentives to attract buyers and enhance transaction activity.

The office market expected to remain under pressure as businesses and employees continue to adopt flexible working arrangements, and companies look to reduce their central operational costs. Some companies are reconsidering their office space requirements more global shifts in the way we work. To minimise the impact of the pandemic, landlords continue to offer incentives to maintain occupancy levels and retain tenants.

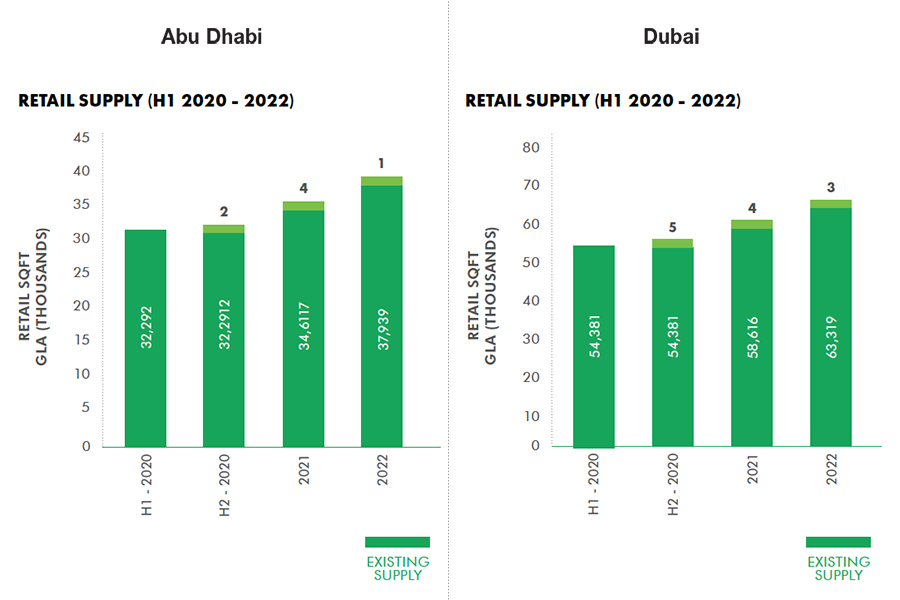

Spending within the retail sector is likely to flow through digital channels more and more, as the adoption of e-commerce accelerates. Retailers who can quickly provide a seamless experience across both physical and digital formats are likely to thrive in an increasingly competitive retail market moving forward.

And although travel restrictions in Dubai have eased, hotels remain focused on domestic tourism, offering attractive staycation deals. Whilst several hotel chains announced temporary closures during the summer months, utilising the opportunity for renovation and property improvement plans.

CBRE expects the temporary mass remote working experiments brought on by COVID-19 to accelerate the trend of flexible working strategies, rather than lead to a wholesale structural shift away from office use. Workers expected to visit their office less frequently. Still, when they do, it will be to collaborate and create with their colleagues, as such, office spaces expected to become more flexible and agile, increasing hybrid workplace and larger space per employee. As anticipated professionals to continue a flexible workstyle, there is a strong focus by developers on flexible residential unit designs to allow and accommodate ample WFH space. Furthermore, as residents’ home-time increased, the need for open spaces and green parks is anticipated to become an essential part of residential communities.

More hotel operators are likely to shift their focus on operating hotels and become “asset-light”, concentrating more on their brand and less on bricks and mortar. The adoption of artificial intelligence (AI) will accelerate automation in many hotels, providing a contactless environment for guests. Whilst in the retail sector, the acceleration in e-commerce virtual shopping and frictionless delivery to become increasingly popular for the sector.